본문

Wealth Management Center

Overview

The Yoon & Yang Wealth Management Center provides professional services for asset succession, family business (management right) succession, corporate governance reorganization, development of trust products and trust-related consulting, wealth management, inheritance and gift tax saving, inheritance disputes (e.g., division of inherited property, and return of legal reserve of inheritance), divorce and guardianship, etc.

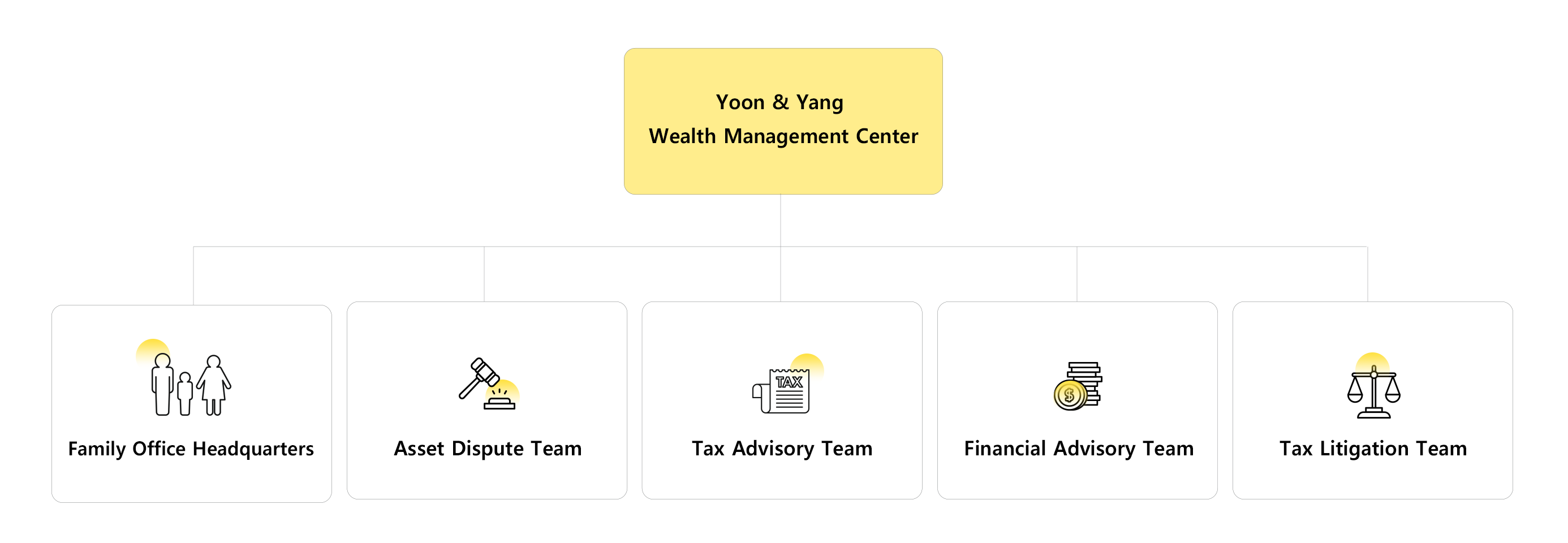

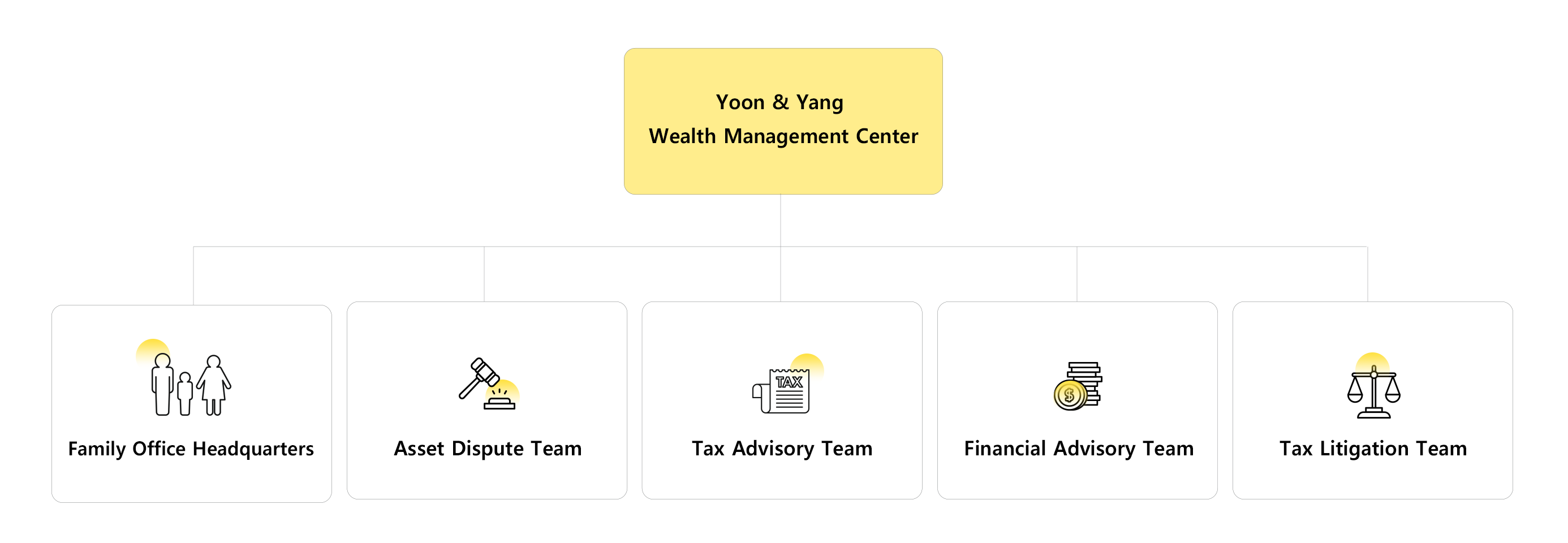

The Wealth Management Center is comprised of the Family Office Headquarters, the Asset Dispute Team, the Tax Advisory Team, the Financial Advisory Team, and the Tax Litigation Team, which consist of experts in the fields of succession, trusts, tax, finance, inheritance, and family law. It provides the overall asset-related services tailored to the various needs of clients, as well as one-stop services based on systematic cooperation with experts from the M&A, antitrust and competition, and corporate law practice groups.

The Wealth Management Center is comprised of the Family Office Headquarters, the Asset Dispute Team, the Tax Advisory Team, the Financial Advisory Team, and the Tax Litigation Team, which consist of experts in the fields of succession, trusts, tax, finance, inheritance, and family law. It provides the overall asset-related services tailored to the various needs of clients, as well as one-stop services based on systematic cooperation with experts from the M&A, antitrust and competition, and corporate law practice groups.

Key Services

Advice on family business succession and asset succession

- Restructuring and financing plans for succession

- Advice on tax saving and prevention of internal disputes

- Advice on follow-up management

- Advice on preliminary calculation of legal reserve of inheritance, preparation of wills, return of legal reserve of inheritance, and prevention of disputes regarding division of inherited property

- Advice on tax saving measures through family business succession and reorganization of corporate structure for succession

- Advice on corporate mergers, divisions, etc. for succession (including various issues such as corporate law and antitrust law)

- Representation in various filings, e.g., tax return for succession

Advice on asset disputes

- Advice on inheritance, legal reserve of inheritance, guardianship, wills and divorces, etc.

- Legal consulting and advice on preparation of wills, preliminary calculation of legal reserve of inheritance and preliminary division of inherited properties, etc.

- Legal advice on other personal properties and family business succession

Advice on Family Office

- Support for trust business upon cooperation with financial institutions

- Services related to trust as will substitutes

- Estate settlement services

- Advice on development of senior towns, inheritance of senior town clients, and donation planning

- Advice on management and succession of real estate

Advice on Guardianship

- Guardianship initiation/guardianship appointment issues for owners (aging)

- Possible disputes on management rights (scope of voting rights of adult guardians, etc.)

- Additional family disputes among the family members after the death of the owner (division of inherited properties, management right disputes, etc.)

Representative Cases

- Advised a leasing company on asset inheritance strategies (including emigration)

- Advised a confectionary company on conversion into a holding company and succession

- Advised an investment company on governance improvement

- Advised a leading apparel company on corporate succession strategies

- Designed corporate succession strategies for a global auto-part company and provided advice on inheritance tax saving

- Advised a medical center on tax reduction through real estate securitization

- Advised a corporate group on inheritance/gift tax strategies

- Advised a leading steel company on family business inheritance deduction

- Advised a pharmaceutical group on governance improvement (including conversion into a holding company)

- Advised a cement group on governance matters

- Advised a corporate group on governance improvement and family business succession

- Advised a chemical product manufacturer on family business succession

- Advised a furniture group on inheritance

- Represented the owner of a paper manufacturer in inheritance disputes

- Advised domestic banks and securities companies on trust as will substitutes

- Advised financial institutions on guarantee of tax payment

- Handled inheritance tax returns and relevant investigations

- Handled audits of sources of funding

- Handled transfer income tax returns and follow-up management

- Advised on and handled investigations regarding deduction of tax on family business succession

- Advised on conversion to a real name of entrusted stocks

- Advised on governance improvement and IPO

- Advised on trust strategies

- Advised on establishment of an estate settlement center

- Advised on launch of trust products

- Advised on education and training of employees handling trust and finance

- Advised a foundation and public interest companies on trust contribution

- Advised on governance of a senior town

- Advised on development of trust products for security deposits for senior towns